What is Preferred Stock?Preferred shares are different from common stock, the one most people are familiar with. Both are equity in a company, but preferred stock typically pays a higher dividend. And that may be attractive in this current low-interest rate environment because most bonds offer much lower yield.

|

WHY CAN Preferred Stock YIELD BETTER THAN 4%?

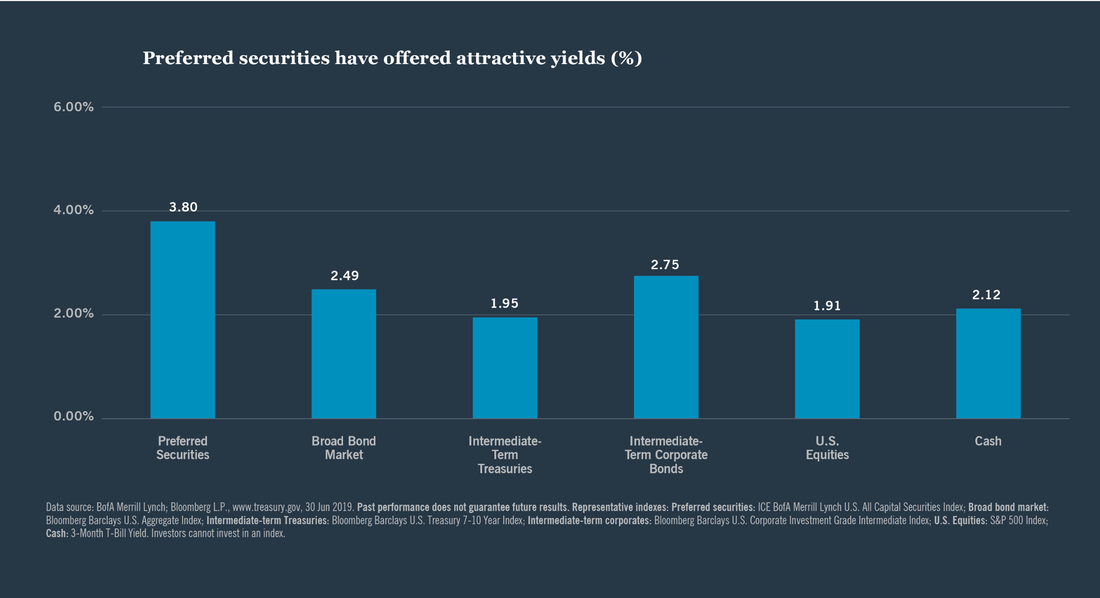

According to a 2019 preferred stock study done by Nuveen at TIAA, preferred securities have had attractive average yields relative to other asset classes. They have offered more income-generating power than equities and most fixed income asset classes, with the exception of high-yield bonds. Note that our research shows that the preferred stocks with higher yield (4 to 5%) with reasonable quality can be found during the same time period.

|

HOW TO INVEST IN Preferred Stock BY YOURSELF?

|

|

Pros:

|

Cons:

|